Triple III Explainer

Numerous tax changes took effect in Kansas as a result of Senate Bill 1, enacted in June 2024. 121, enacted in March 2023, simplified the individual income tax system in Montana and, effective January 1, 2024, reduced the number of tax brackets from seven to two with the top tax rate of 5.9 percent. Some states double their single-filer bracket widths for married filers to avoid imposing a “marriage penalty.” Some states index tax brackets, exemptions, and deductions for inflation, while many others do not. The normal balance federal Tax Cuts and Jobs Act of 2017 (TCJA) increased the standard deductionThe standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. Taxpayers who take the standard deduction cannot also itemize their deductions; it serves as an alternative. (set at $15,000 for single filers and $30,000 for joint filers in 2025) while suspending the personal exemption by reducing it to $0 through 2025.

Future Outlook: Will California Tax Brackets Change?

The state also imposes an additional 1% Mental Health Services Tax on taxable income exceeding $1 million, creating an effective top rate of 13.3%. In addition to the California corporate income tax, http://svinterior.in/2021/12/08/over-and-short-definition-and-what-it-means-in/ California corporations must also pay the federal corporate income tax. Like the personal income tax the federal business tax is bracketed based on income level, with eight corporate tax brackets.

How Can You Pay Less in California State Income Tax?

- The historic tables, however, have been updated to account for retroactive changes.

- If you want to check the status of your California tax refund, you can visit the California Income Tax Refund page.

- The Tax tables below include the tax rates, thresholds and allowances included in the California Tax Calculator 2021.

- Properly accounting for all income sources is important.

- If you want to compare all of the state tax rates on one page, visit the list of state income taxes.

California’s ongoing budget challenges and political environment suggest continued tax complexity and potential rate increases. Law california state income tax rate firms should stay informed about proposed legislation to enable proactive planning rather than reactive adjustments. Essential records include detailed business expense documentation, income source verification, and residency supporting materials. Digital recordkeeping systems often provide superior organization and accessibility compared to traditional paper systems.

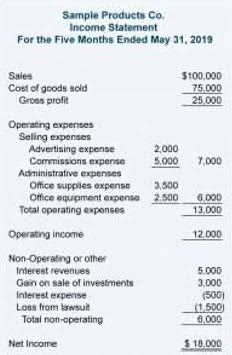

Revenue vs Profit: Key Differences

California has some of the highest income taxes in the country, with rates ranging from 1 percent to 12.3 percent for income earned in 2024, reported on tax returns due in 2025. Unlike some states that have no income tax, California has one of the highest state income tax rates in the country. The state uses a progressive tax rate system, with rates ranging from 1% to 12.3% in 2025. 259, enacted in September 2023, North Carolina accelerated the reduction of its flat individual income tax rate. Effective January 1, 2024, the tax rate decreased from 4.75 percent to 4.5 percent. The rate is scheduled to decline to 3.99 percent by 2026.

However, an extension does not delay the payment due date. Understanding available deductions, such as home office expenses, aids in tax reduction. These deductions are designed to reflect common costs in self-employment. Part-year residents, however, report all income during their California residency. Afterward, they switch to reporting only California-sourced earnings.

California has nine state income tax brackets, with rates ranging from 1% to 12.3%. If your taxable income exceeds $1 million, you’ll pay an additional 1% under the Mental Health Services Act, bringing the top marginal rate to 13.3%. To illustrate the calculation, consider a single individual with a gross income of $85,000 and no dependents. The first step is to subtract the standard deduction for a single filer, which is $5,540. This reduces their taxable income to $79,460, the figure used to calculate the tax based on the marginal brackets.

- This alleviates some of the financial burdens of raising children.

- Remember that California may have very different deduction laws from the Federal Income Tax, so you may have to write a whole new list of deductions for your California income tax return.

- Most tax preparers can electronically file your return for you, or you can do it yourself using free or paid income tax software, like the examples listed below.

- California’s maximum marginal income tax rate is the 1st highest in the United States, ranking directly below California’s %.

- With TurboTax, filing taxes is smooth, simple, and tailored to you.

Federal Corporate Income Tax Brackets 2025

The information provided on this website does not, and is not intended to, constitute legal, tax or accounting advice or recommendations. All information prepared on this site is for informational purposes only, and should not be relied on for legal, tax or accounting advice. You should consult your own legal, tax or accounting advisors before engaging in any transaction.

- As incomes rise, taxpayers move into higher tax brackets, facing higher rates.

- In compliance with the regulations set forth by California, employers are mandated to adhere to specific payroll deduction requirements.

- Advisory services are only offered to clients or prospective clients where Sweeney & Michel, LLC and its representatives are properly licensed or exempt from licensure.

- This makes the EITC a powerful tool for reducing poverty, incentivizing work, and providing financial support to those who need it most.

- In California, the income tax rate ranges from 1% to 12.3% – nine brackets.

- The information provided on this website does not, and is not intended to, constitute legal, tax or accounting advice or recommendations.

The tax environment in California is tricky and strict about deadlines; missing deadlines leads to penalties. You can delegate your Bookkeeping, Accounting, CFO, and Taxation needs to us. At Profitjets, we ensure you file your taxes accurately and promptly. Our 600+ customers are a testament to our proficiency with outsourced bookkeeping and accounting services, CFO services, and tax planning. California allows for both standard and itemized deductions. Common itemized deductions include mortgage interest, property taxes, and charitable donations.